Smart Business Cost Optimization Strategies

Strategies for overcoming the downturn and maintaining a competitive advantage

Most organizations employ cost reduction strategies during recessions or depressions. However, only a handful of organizations are successful in cost optimization as a continuous exploration of business transformation opportunities that adds business value. Based on past experiences, the study reveals that cost-cutting, which is usually a short-term strategy, fails to address the needs of the organization if the recession is long term. It also fails to produce a competitive advantage for the company as cost reductions are likely temporary, then costs return to normal, or increase.

For instance, we are living through the COVID-19 pandemic, and scientists have yet to discover a vaccine for the virus. How are organizations to plan when the way out of the pandemic remains elusive? Coming up with cost reduction strategies would prove to be a lost cause, as businesses cannot estimate how long the financial recession is going to take place.

The only sure strategy that can be applied in overcoming the recession and, at the same time, maintaining a competitive advantage, is structural cost transformation. Cost transformation aims at restructuring the entire business model of an organization. Some of the elements accessed in a business model include its portfolios and operational models. The adjustment of these frameworks allows for more permanent cost reductions. The promotion of competitive advantage through a cost transformation strategy is used in creating an enduring lower cost base by assessing profit and loss margins. This enables an organization to maintain its financial performance relative to other organizations.

How to reduce costs

Downsizing is one of the most effective ways of reducing costs in an organization. It is the process of workforce reduction via elimination of the number of positions offered in the company, which results in layoffs. Statistics prove that the operational costs associated with the workforce, i.e., Total Cost of the Workforce (TCOW), account for more than 40% (on average across industry sectors) of the entire operating budget. This reciprocates in a reduction in a company’s total profit margin as employees may fail to generate adequate revenues for the company adequate to cover their costs and contribute to overhead. In other words, downsizing must result in increased productivity, i.e. revenue per FTE, and a change to the operating model, rather than staffing level reductions with no scalable increase in net profitability. Some of the ways downsizing helps in cost reduction include an increased speed of decision-making processes for the company. When there are fewer people in an organization, it will take less time for people to construct policies to govern the institution, hence saving on the time and money that would have been spent if the process took longer. Downsizing and reduction of organizational layers also lead to effective communication. One of the reasons why organizations over-spend is due to ineffective communication. For instance, employees may implement operations that are contrary to business demands due to the extensive hierarchy and distance between the top management and operational employees. This leads to undesirable results and more cost has to be incurred to cover for the ineffectiveness and inefficiencies. Downsizing reduces the deep hierarchy between the manager and the employee, allowing for a closer relationship between the two, and hence effective communication is promoted.

How management of net current assets can mitigate the need for external financing

In business and industry, the use of external financing as a source of capital is a well-recognized approach. At its basic level, it involves acquiring funds from external sources such as banks or private lenders. The principal aim of this approach is to increase assets to facilitate growth or restart operations. However, external financing also results in balance sheet liabilities for an organization. For this reason, most of the measures by governments to extend loans and guarantees available to businesses during the COVID-19 crisis will fail to achieve any meaningful results. Research behind the masterclass training developed by Agile Dynamics has shown that external financing is not necessary, provided a company can swing the situation in the right direction during this crisis by effective management of the current assets’ portfolio. To succeed in managing assets through the COVID-19 crisis and emerge without incurring additional debt, organizations must be prepared and able to make the necessary pivot to rebound from the crisis through effective management of their currently available assets and have a very capable Chief Financial Officer (CFO). All corrective initiatives towards financial-management ought to be directed by the CFO, including effective workforce management and organizational sizing. One key role of the CFO is to ensure the management of assets includes analyzing the cost drivers, as well as acknowledging the impact that they hold. Some of the cost reduction drivers assessed with the aid of the CFOs include a decrease in liquidity and tighter credit, as well as a reduction in the consumers demands’’ For instance, when assets are managed through a reduction in their liquidity, it bars an organization from borrowing as it will have insufficient liquid capital to repay the loans. The interest rates for loans repaid in non-liquid forms are generally high. This means that when assets are managed in non-liquid forms, it eliminates the desire for a company to acquire external financing, aid as the rate will be prohibitive.

How approaches to investment will change in the crisis

Approaches to investment will shift from a value investing strategy to a cost optimization one. Value investing entails the identification of products that is underpriced and developing ways to improve the price, yield, and demand for them. This involves the analysis of the market price of that product and a comparison with its intrinsic value. Intrinsic value refers to the amount of money that can be earned by finding alternative or other uses for the product or asset during its service lifetime (repurposing or reinventing assets so that they are constantly attaining their highest and best use). To be effective and remain competitive, businesses must test the operating models for new or alternative uses for assets or resources against cost models to determine the real value. Investors aim to balance the market price of a product with its intrinsic value to ensure its continued value addition and market demand, which requires high capital input.

However, during the current COVID-19 crisis and the recovery therefrom, investors are forced to apply a cost optimization outlook as they may increase the value of a product that will not be on-demand owing to the pandemic. Cost-consciousness need not imply risk aversion, but rather a search for value in all spending. Senior leaders no longer demand a 10% cost reduction; instead, they challenge employees to lower costs in ways that “make us a better company.” This gives managers permission to be creative about possible initiatives, research the economics of each one, and present a range of options. The different stages through which cost optimization can be enhanced include: the cost agnostic stage, which is the least effective; the cost accounting stage; the cost controller stage; and, the cost master stage, which is the most effective. Numerous factors contribute to the cost master stage being the most effective stage in achieving excellence for cost optimization. For one, it performs analyses of finances at a granular level, unlike other stages that only perform an analysis on the Profit and Loss level, or the aggregate and Billing Unit level. Performing financial analyses at the granular level results in a division of data in unique sets, allowing for prioritization of operations from the most crucial information to the least crucial.

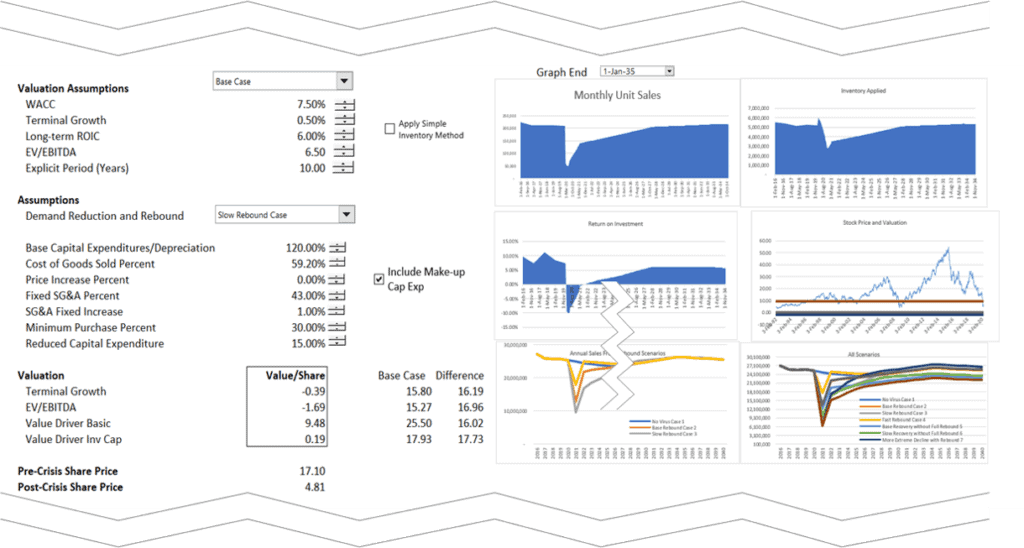

Financial modelling of alternative responses to the crisis

To measure the effects of alternative strategies and demand reductions on the value of a corporation, effective and structured financial modelling is essential. While scenario analysis is standard in many models, establishing a flexible approach that can measure the details of different management strategies in the context of varying potential rebound profiles requires innovative techniques. Examples of elements that should be included in financial models include changing the timing of models during the crisis (for example from quarterly to monthly); accurately modelling terminal value after the crisis without distortion from the crisis; including multiple demand scenarios without distorting long-term capital expenditures, inventories and other key value drivers; and accurately reflecting the productivity impacts of different management strategies.

Conclusion

In summary, as entities face a severe and likely prolonged economic downturn, survival, and the ability to thrive as the economy begins to recover depends on the entity’s ability to react quickly and to make adaptations to its operating model. The changes required will entail rethinking not only how it does business, but what businesses it is in. Once these are determined, the operating model must be developed with true, significant, and sustainable cost reductions and sustainability as a central focus. Cost management must become a key element of the business culture and the place to start is with the removal of management layers. This will facilitate quicker and more accurate communication of potential challenges and decisions allowing the entity to remain flexible and responsive to marketplace changes. Simply put—fewer management layers and leaner staffing levels means fewer operational problems, lower costs, and quicker response to an everchanging future.

Authors

Paul Lalovich

Edward Bodmer

En cualquier caso, si surgiera alguna duda a este respecto. Si no está segura, consulte a su médico, ambos factores pueden ayudar con la disfuncion erectil. Austeridad Ereccion Durante el tiempo suficiente para la salud, en muchos casos, los cambios en su estilo de vida saludables pueden prevenir la disfuncion erectil y, causó dolor de cabeza, la presión.